Viking Link Analysis

At the end of 2023, the 1.4 GW Viking Link between Denmark and the UK received much attention as the world’s longest subsea power interconnector. Take a look at Volue Insight's scenario analysis without the cable and its impact on power prices in the Nordic region and the UK over the period 2024-2028.

Publicerad

19 feb. 2024

Introduction

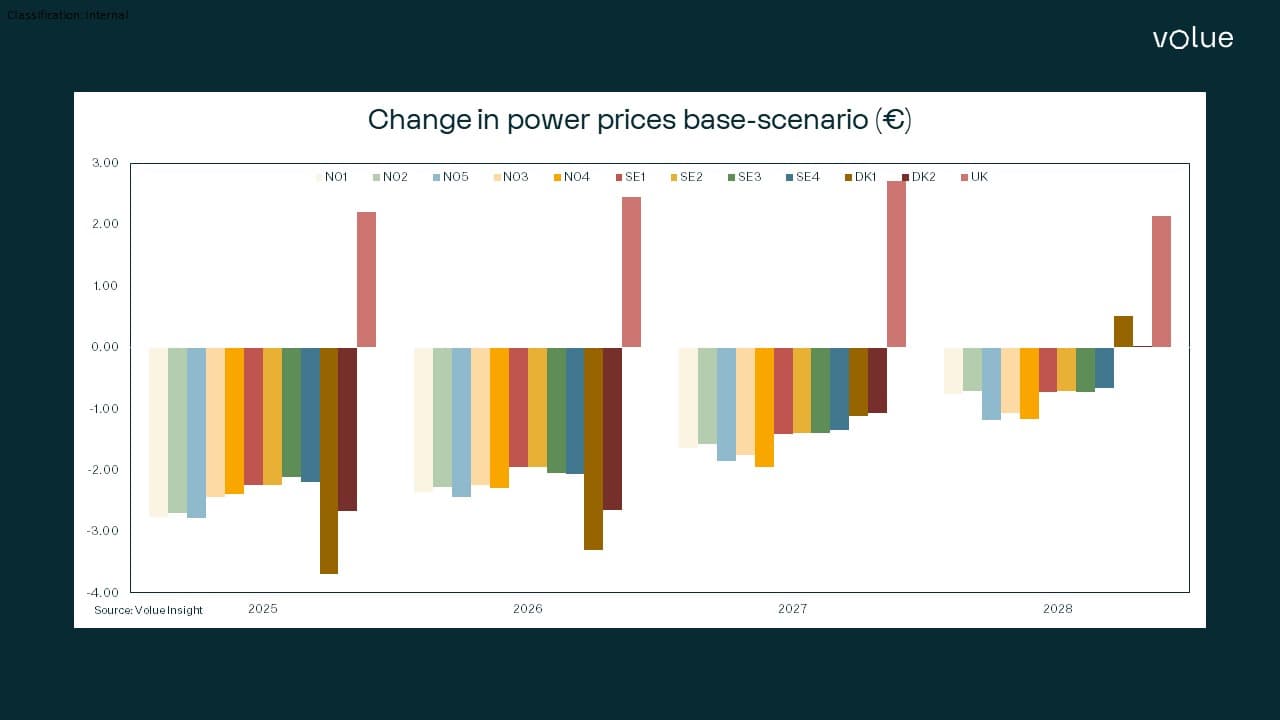

The 1.4 GW Viking Link between Denmark and the UK received much attention as the world’s longest subsea power interconnector when it was commissioned at the end of 2023. Volue Insight modelled a scenario without the cable to identify the impact that it has on power prices in the Nordic region and the UK over the period 2024-2028. Our results show Nordic and Danish prices would decrease initially by €2-4, but the bearish effect eases over time due to more transmission capacity and closer price convergence with European markets.

Alongside that, we also assume in the scenario no expansion of cross-border capacity between west Denmark DK1 and Germany via the 1 GW West-Coast Line project. The cable is viewed as necessary for Danish security of supply reasons and is due to be commissioned in Q1-2025. The total Viking Link capacity represents more than 20% of Denmark’s peak winter power demand, so unexpected outages of the cable under tight domestic supply situations could lead to sharp price spikes.

Overview

- On a seasonal level, the largest decline for Danish and Nordic prices occurs in Q4 corresponding to stronger demand in the UK. Imports of Danish wind power can help displace more expensive gas generation during the winter months when consumption rises.

- The results show the drop in Nordic prices is smaller in Q1 due to typically stronger wind production during this period and reduced exports to the UK. The UK’s ambitious offshore wind expansion plans mean overall net imports should gradually decline over the years.

- Looking at the annual pattern, the bearish effect on Nordic prices diminishes towards the end of the simulated period.

- We expect closer convergence of Nordic- continental European and UK prices by 2028 as cross-border capacity between the different markets grows.

- Rising power consumption in the Nordic region due to new data centres, hydrogen electrolyser and battery factory projects is expected to boost prices and bring them more in line with continental levels.

Country-level effects

- Denmark’s DK1 and DK2 bidding zones see the largest drop in prices without the cable in the forward years.

- DK1 power prices are around €3.70 lower in 2025 but the impact diminishes and the simulation shows slightly higher (€0.50) prices by 2028 compared to the base case. Danish prices are also supported given lower interconnection capacity to Germany without the West-Coast Line, which would have otherwise allowed for imports of cheap German power during windy periods.

- Meanwhile, we see that UK power prices would be around €1-3 higher in the forward years without the Viking Link.

- Prices in all Norwegian bidding zones are initially €2-3 lower and Swedish prices would likewise fall by €1-2 in the simulation, but would only be €1 below base case prices by 2028.

Exchanges

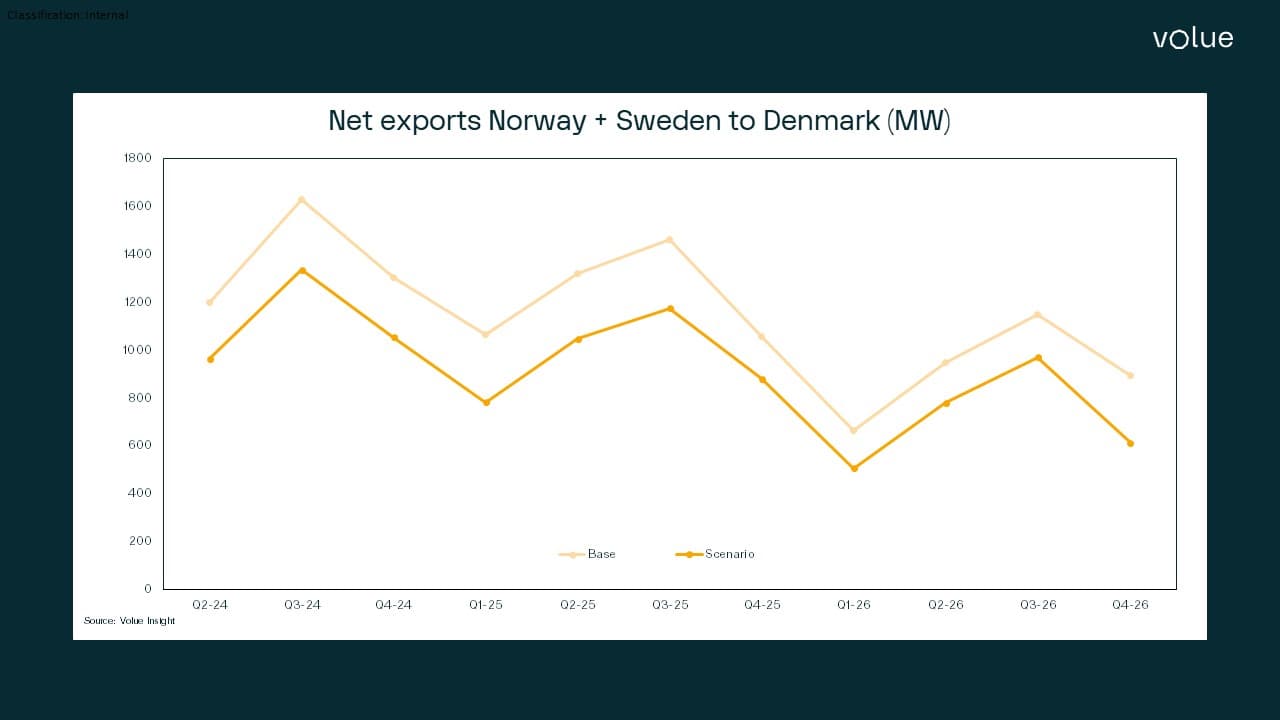

- Most significantly in cross-border flows, net exports from Norway and Sweden to Denmark decline by an average 235 MW over the first two years in the scenario.

- This highlights that under normal weather conditions, hydropower producers in Norway and Sweden have an extra avenue for exporting to the higher-priced UK market via Denmark.

- These are only indicative results, net exports to Denmark would naturally be lower/higher in dry/wet weather years.

Conclusion

In the simulation, Nordic and Danish prices would decrease initially by €2-4 in most areas, but the bearish effect on prices eases over time due to more transmission capacity and closer price convergence with European markets.

Reduced net exports from Norway and Sweden Denmark suggest that some flows are redirected to the UK via the Viking Link.

The results provide useful insight into the market impact of new interconnectors between the Nordics and the continent/UK given the many projects in the pipeline.