Contact us for more information about our solutions

Short-Term Price Forecasts

Our short-term model, SpotEx, forecasts cross-border power flows and prices based on internal weather-driven fundamentals and market data. Updated continuously, 24/7, at 15-minute resolution with a horizon of up to 90 days, it provides comprehensive analysis and visualisation of alternative weather scenarios.

Flow-based market coupling forecasts

Access PTDF (Power Transmission Distribution Factors) forecasts for Core and Nordic flow-based domains to evaluate spreads and market coupling strategies.

Data & forecasts at different granularities

Get forecasts in 15-minute, 30-minute, or hourly resolution (or Market Time Unit), depending on the market, for precise day-ahead, intraday, and balancing insights.

Multiple weather models & scenarios

Use forecasts built on multiple weather models and scenarios to capture uncertainty and stress-test strategies under varying market conditions.

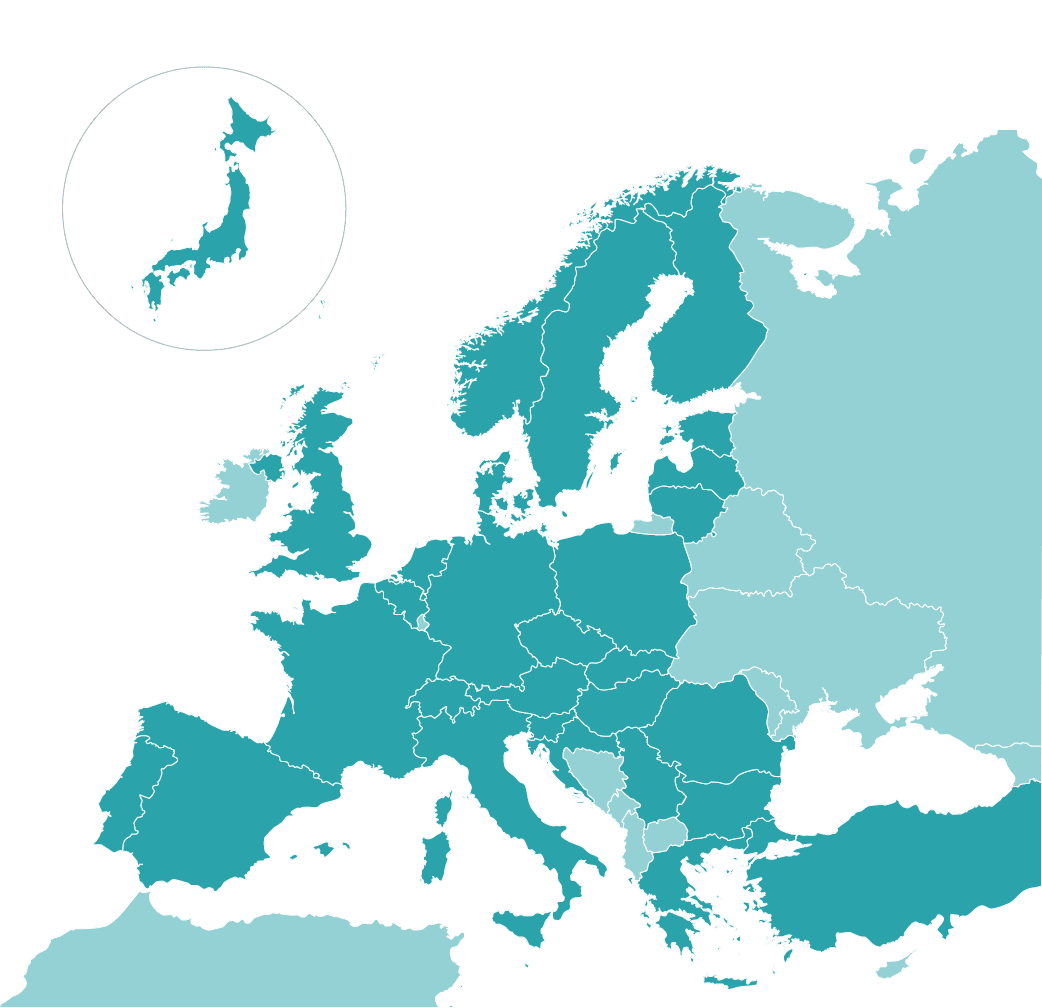

Available regions

Ahead of the game with technological advantages

Market coupling & spreads

Get an in-depth overview of interconnected energy markets, including price spreads and flow-based domains. Strengthen cross-border trading strategies with accurate, timely data.

User-friendly access

Access forecasts easily via API, Excel, or Python tools for custom analysis, modelling, and benchmarking. Seamless integration enables quick adoption into existing workflows.

Expert insights

Leverage comprehensive reports and analytics that combine quantitative modelling with regional market expertise. Our analysts provide context, turning complex data into data-driven decisions.

AI-driven price modelling

Combining machine learning, UMMs, and domain expertise, our models deliver accurate short-term price forecasts that adjust in real time to market events, enabling faster and smarter decisions.

Contact us for more information about our solutions

Do you want to learn more about our short-term price forecasts?

Discover how our short-term price forecasts support trading decisions in day-ahead, intraday, and balancing markets. Get in touch to book a demo, request a free trial, or speak with one of our experts.

Mats Zachariassen, Solution Sales Expert at Insight by Volue