Exploring Solar Capture Prices: Long-Term Developments in Germany vs. UK

Renewable projects in many European countries are increasingly operating on a merchant basis, subject to fluctuations on the wholesale market rather than the security of long-term government feed-in-tariffs. We have chosen to explore capture prices of solar PV given steep reductions in the levelised cost of electricity (LCOE) over the past years, meaning it is frequently being built without subsidies. In this post, we will compare Insight by Volue’s long-term outlook for capture prices between two markets, Germany and the UK.

Forfatter

Tasmin Chowdhary

Publisert

2. mai 2024

Why is the topic of capture prices important?

- The capture price is defined as the volume weighted average spot market price for a renewable technology, reliant on the total production of that technology and baseload power prices in a given period.

- It’s important to know what solar or wind generators can earn on a merchant basis as government subsidies fade and we shift to a new market structure where integration of intermittent renewables and other forms of flexibility leads to more volatile and dynamic spot power prices.

- The EU has set ambitious goals for 2030 and aims to reach net zero emissions by 2050. Without sufficient market revenue potential, the necessary growth in solar and wind capacity for meeting national and EU targets won’t be achieved.

- On the other hand, rapid buildout of zero marginal cost renewables leads to the price cannibalisation effect.

What is the trend so far?

Capture prices for solar in Central-West Europe were stable from 2018-2020 at close to baseload prices but they have been declining during recent years. Increased solar PV capacity buildout has led to price cannibalisation, where simultaneous high feed-in decreases the spot price and therefore, revenues for all systems. Our data shows that solar is particularly affected by price cannibalisation given production tends to be concentrated during the midday hours across markets, meaning the ability to export excess volumes is limited. Solar is shaping hourly spot prices today, where we frequently observe negative and very low prices across Central Europe during the afternoon peaks in output, the so-called ‘duck curve’ effect. This weakens average power prices across the weeks and months of spring when solar production is strongest but demand muted. For example, surging solar generation has led to Spanish hourly prices plunging to negative territory for the first time.

Germany: cannibalisation strongly hits producers

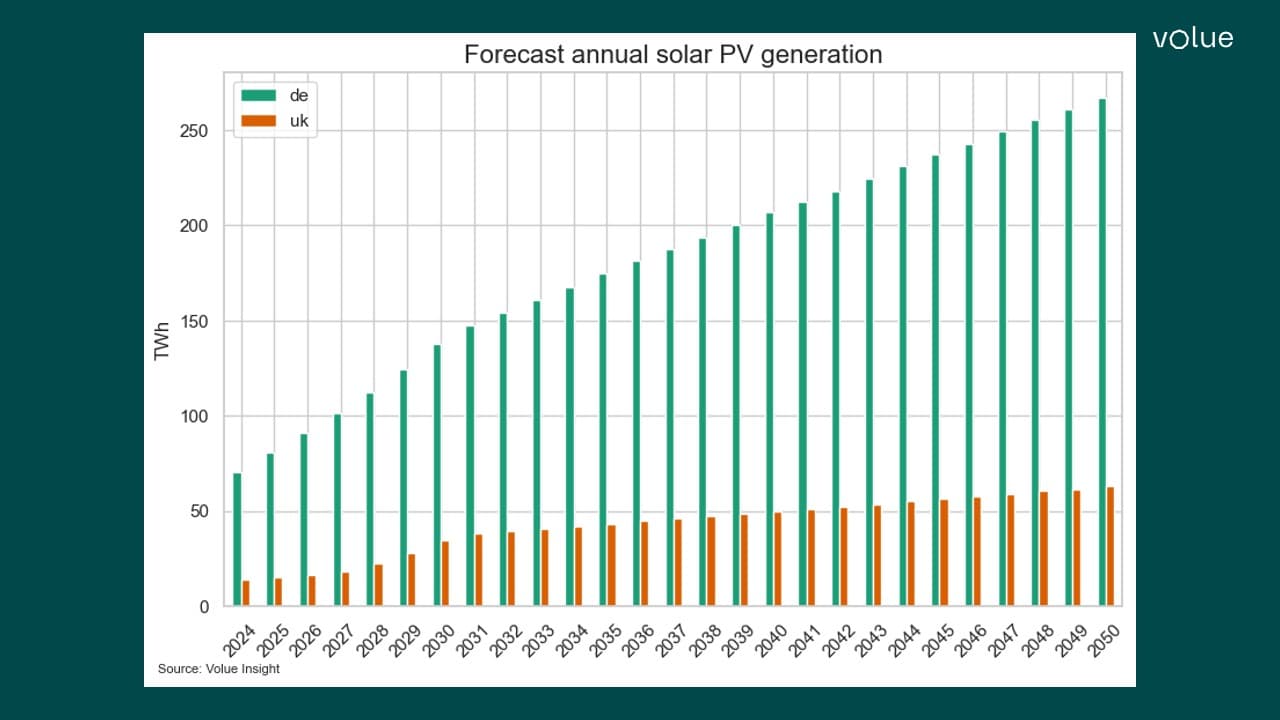

Germany saw record solar PV additions last year and we forecast capacity growing from 74 GW in 2023 to reach 341 GW in 2050, translating to annual production of 280 TWh (see chart above).

The solar capture rate, the percentage expression of the capture price over the baseload price, has hovered at 80-90% over the last couple of years. At Insight by Volue, we have a specific metric, Profile Deltas defined as the difference of capture price and baseload power prices indicating the relative profitability compared to the market.

Summer 2022 saw a surge in German PV capture prices to over €399/MWh in August, but they were still at a €66 discount to the baseload, meaning that even during the peak of the European energy crisis the capture rate was 86%.

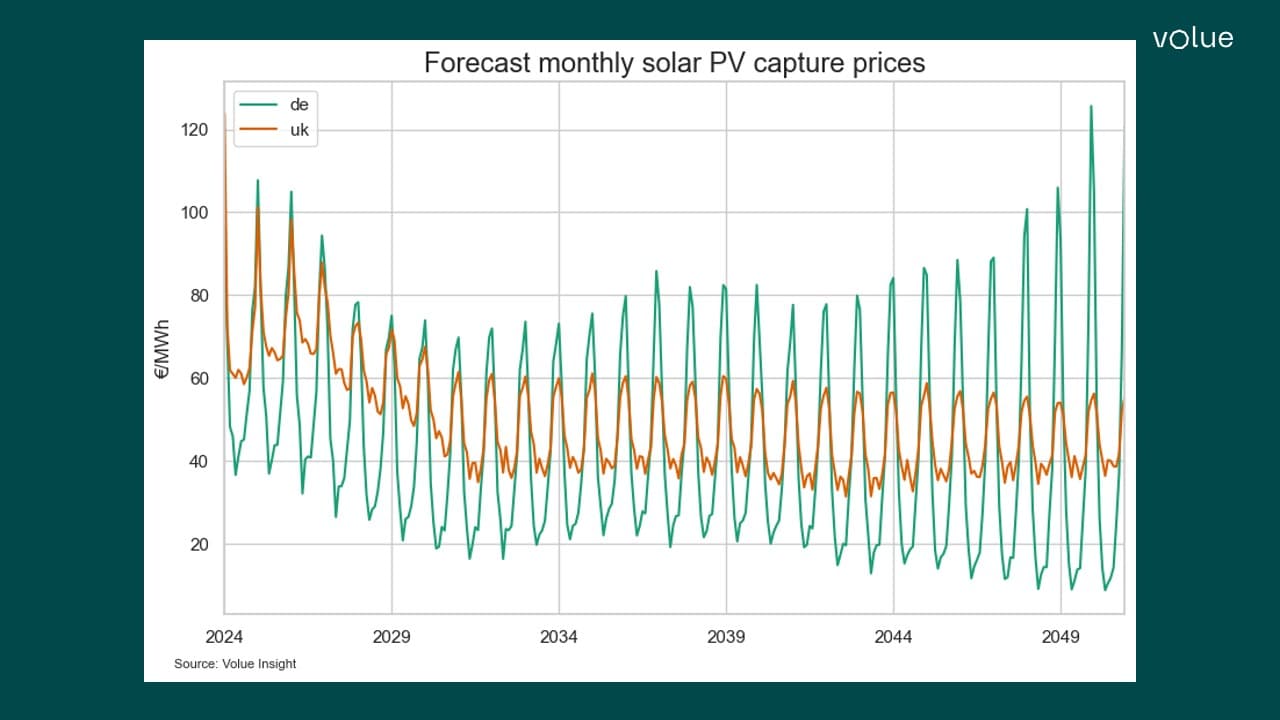

This was an exceptional case and we forecast capture prices declining further in the coming years, with huge monthly variations due to the cannibalisation effect as capacity grows.

Naturally, we observe sharper decreases in capture prices during the summer, when production is at its peak, compared with the winter, when prices tend to be higher but production lower. For example, forecast PV capture prices by 2050 range from €120/MWh in December to €9/MWh in May in our base case.

On an annual level, the phaseout of Germany’s remaining 26 GW of coal and lignite capacity by 2035 lifts baseload prices and thereby capture prices.

UK: lower output share limits capture price downside

Solar capture rates in the UK are likewise expected to decline but annual prices should recover towards 2040 as more flexibility is deployed such as hydrogen electrolysers and battery storage capacity. On average, additional consumption during periods of renewable oversupply limits the price-dampening effect.

In contrast to Germany, UK solar capture prices show a flatter and more stable profile in the long run due to the relatively limited role of the technology in the overall power mix.

We forecast annual UK solar production reaching 62 TWh by 2050, up from 13 TWh last year. The market penetration of solar is greater in Germany, where it is expected to become the second largest generation source following wind and should account for 31% of the power mix by 2050 compared to just 12% in the UK.

Wind should also be the UK’s dominant source of production by 2050 but more nuclear in the stack limits spot price volatility and consequently, solar PV capture price variation.

Conclusion

Our forecasts show that solar capture prices in Germany and the UK should, on average, decline in the long run with growing capacity.

Germany’s planned coal and lignite phaseout temporarily boosts the capture rate from 2030-2035 but a rapid influx of renewables weighs on the overall capture rate out to 2050.

German capture prices are forecast to face significant seasonal volatility because of the relatively higher share of solar in total power production, contrasting to the flatter profile in the UK market linked to more stable nuclear output in the mix.

Large variation in prices highlights the risks attached to investments in new-build solar plants in these markets, particularly to the downside in the summer when the price cannibalisation effect is most notable.

New flexible capacity, for example, batteries, can already profit from the rising incidence of negative prices and periods of renewable oversupply. However, we forecast a lack of flexibility in the short term. Increased buildout of these assets should support the capture price development and enhance the market revenue potential for solar producers in the 2040s.

Get in touch

Volue offers not only baseload capture prices but weather scenarios to identify the variation in prices under different climate conditions.

Contact us today to learn more about our capture price offering or to get access to the extended version of this comparison in our recent capture price webinar recording.

Mats Zachariassen