Growth of renewable energy

European countries have made significant investments in renewable energy infrastructure and have developed strong grid connections across borders. This has enabled efficient integration of renewable energy sources and has led to innovative trading practices.

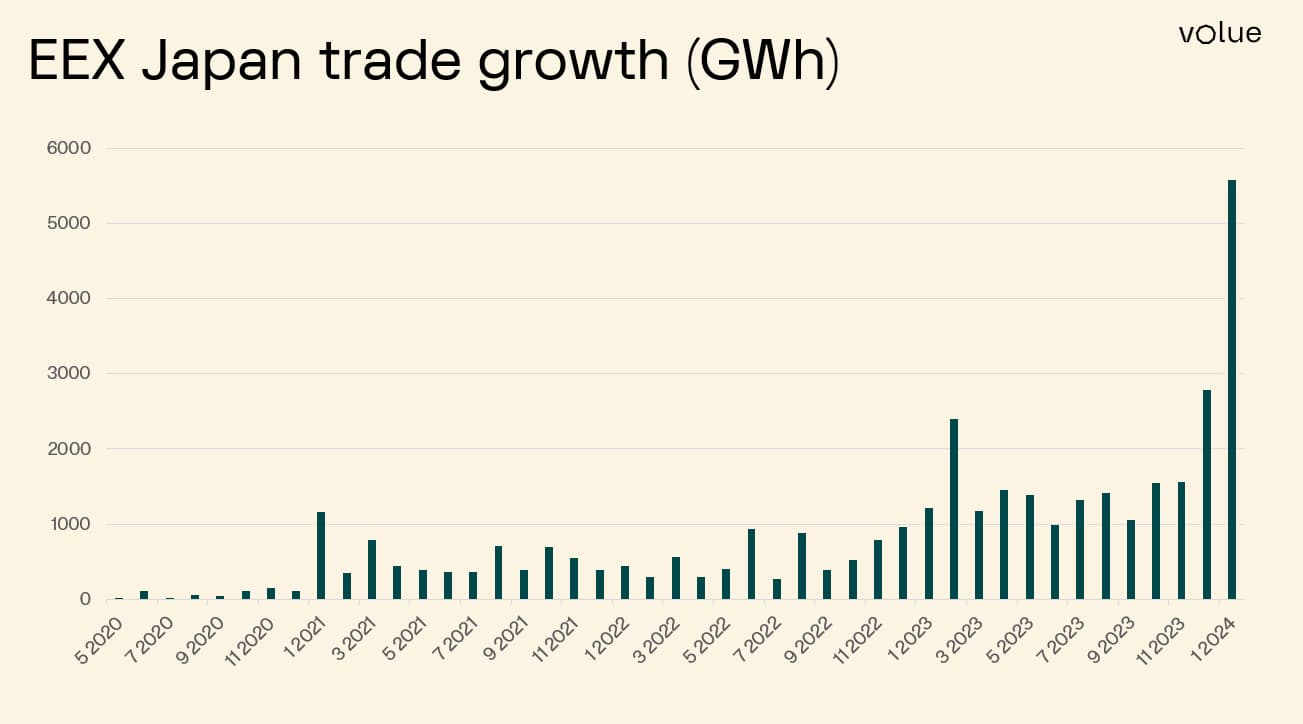

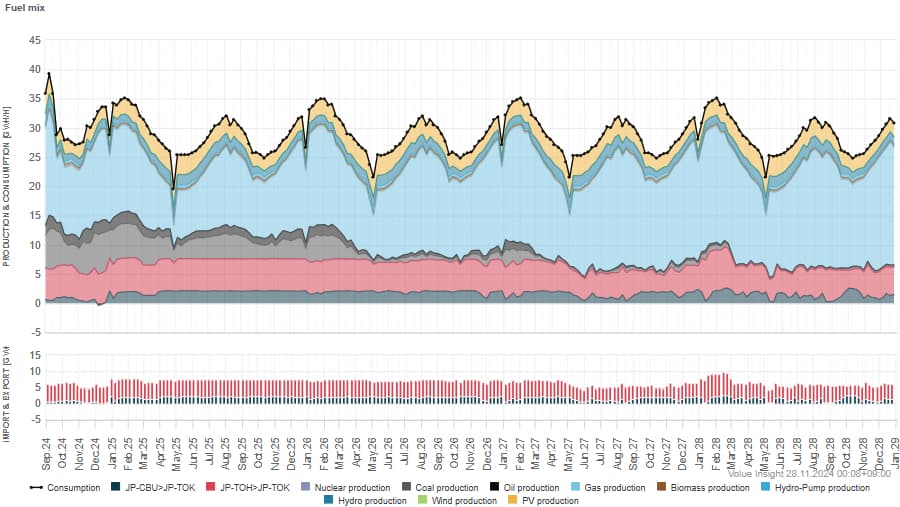

The diversification of trading participants in Japan has been progressing, driven by the growth of renewable energy since the introduction of the FIT scheme and now the FIP scheme. However, Japan's island geography limits the kind of interconnected grid infrastructure seen in Europe. However, by investing in robust grid technologies and storage solutions, Japan can improve its power trading potential and enhance resilience against natural disasters.

Leveraging data and technology for efficient trading

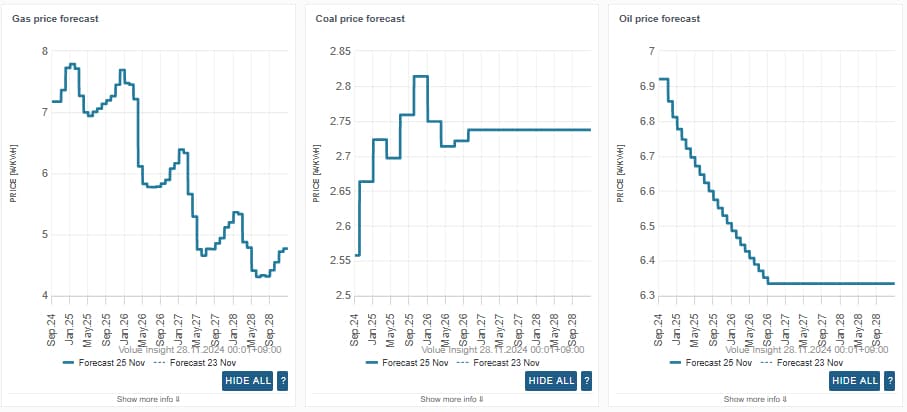

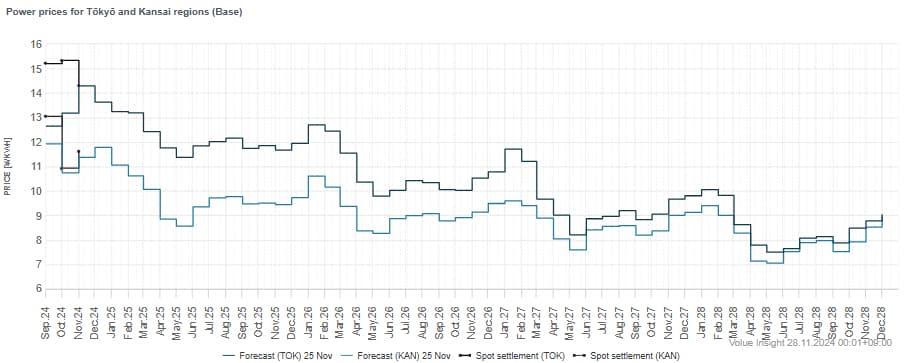

In Europe, advanced technology, including AI and machine learning, helps manage power trading efficiently. These technologies analyse historical data, weather forecasts, and market trends to make accurate predictions, facilitating automated trading decisions.

Japan can adopt similar technologies to better manage power demand and optimise the distribution of energy. Additionally, having real-time data on supply, demand, and price trends could improve Japan’s trading accuracy and help balance supply with demand fluctuations.