Intraday market transparency from October 2026

In addition to the anticipated reform in the balancing market system, JEPX will publish intraday bid information grouped into five regional zones:

- Hokkaido

- Tohoku & Tokyo

- Chubu, Hokuriku & Kansai

- Chugoku & Shikoku

- Kyushu

This five-zone approach strikes a balance between transparency and confidentiality, mitigating risks of exposing short-run marginal costs (SRMC) while giving market players better visibility for imbalance management.

JEPX system revision

According to JEPX’s latest release, published on 26 November 2025, the spot and intraday trading system will fully migrate to a new API-based platform, the former in April 2026 and the latter in October 2026, eliminating the existing GUI interface. As a result, participants should prepare for:

- Server-to-server communication instead of manual bidding

- Retraction of fee revisions: Despite the previously announced plans to revise fees in April this year, membership fees, as well as spot and intraday transaction fees, will remain unchanged for FY2026 at JPY 30/MWh (spot) and JPY 100/MWh (intraday).

Implications for market players

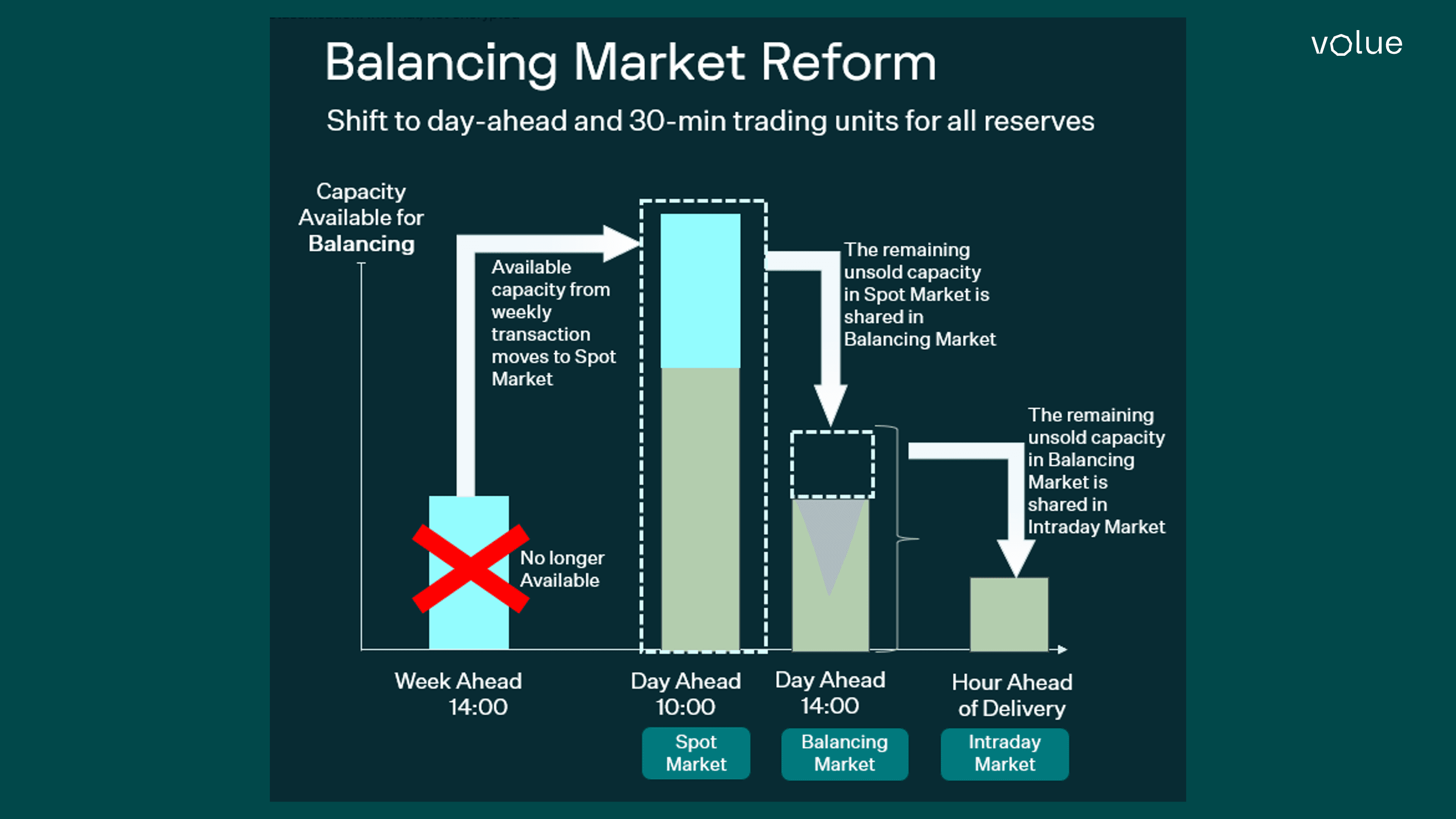

The move to shorter intervals and day-ahead clearing will increase operational complexity, requiring more advanced forecasting and bidding strategies create opportunities for flexibility providers, with battery storage operators and EV aggregators particularly well positioned to benefit.